While they have become progressively less popular over the last decade, checks are still a valid means of making and/receiving cash payments subsequent to a transaction; the approximately 18 billion checks that are written yearly are a testament to this fact; their purpose range from salary to payments for incentives such as social security as well as personal checks.

What is a Personal Check?

Personal checks are generally regarded as checks that are drawn against funds deposited in your personal checking account.

In contrast to bank checks that are signed by a cashier and that warrant a direct transaction from the financial institution and are cleared quite easily, a personal check is processed from an account – they are usually not guaranteed until they are accepted by the bank. And while the check is a promise that the money will be there when the recipient redeems it, whether hours, days or weeks later, they are risky for the person accepting them and depositing to their account. The payment doesn’t come out of your account immediately, as it would if you paid using a debit card. Instead, the check must be presented, processed and accepted.

Regardless however, personal checks are best suitable for everyday transactions such as shopping, or making small payments for goods and/or services – some small businesses don’t accept credit or debit cards. If you prefer to stay disciplined with your spending, checks or cash can also be a better choice than plastic

Why is it Difficult to Cash Personal Checks?

Personal checks are considerably riskier than government issued checks because they are dependent on the finances available in the writer’s account, which cannot be determined unless the check is processed. The checks also pose a risk to cash if/when the writer has either bad credit, or a reputation for issuing bounced checks.

Besides these, there are a few other reasons why personal checks may not be redeemable;

-

Lack of Proper ID

A means of identification is often required to verify the individual to whom the check was issued; this is perhaps the only means with which banks protect themselves against fraud, as anyone at all can present a check with claims to it.

A government issued identification card such as a driver’s license or a passport is often preferred and widely accepted.

-

The Check was Not Made Payable To The Right Person

It may happen that the issuer of the check writes out one name on the check and the receiver may have it deposited into an account not bearing the name written on the check, perhaps as a result of haste or plain carelessness – this will cause the check to be automatically rejected, except in the case when the check is deposited into a joint account of which the individual is party to.

-

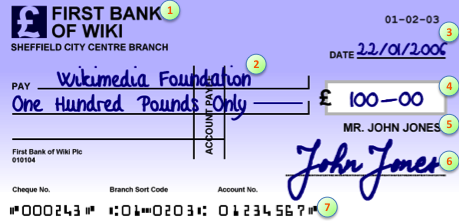

Indications Of Fraud

Banks often inspect the checks for tell-tale signs of fraud such as alterations, smears, stains or discolorations on the check that are indicative of foul-play; any such indications may lead to a refusal to redeem the check.

-

Improper Signatures

It is made abundantly clear by banks that a variation in the signature of a customer renders their documents null and void. Checks are no different. If the signature on the check does not tally with the signature associated with the bank account from which the check is meant to be cashed, it definitely will not be honored.

-

Wrong Dates/Misspelling Errors

Seemingly minor details such as the date written on the check holds enough sway to withhold the check, as an earlier or later date might be indicative of the fact that the check is either invalid or not due to be cashed.

Misspelling errors in the name of the recipient also adversely affect the checks validity.

Where Can You Cash a Personal Check?

The best way to cash any check whatsoever is to use a checking account. However, this is not particularly exciting news for the nearly 8% of Americans who are living ‘unbanked’ (i.e. with no bank account whatsoever), the second most viable alternative to a checking account would be to go to the bank where the writer has the account from which the check is issued – and quite easily the bank can see whether or not funds are available and immediately update the account.

Besides banks and credit unions, there are a few other ways to cash personal checks –

-

Local Check Cashing Businesses

There are probably a list of local check chasing businesses available in your local pages – proceed by calling them to inquire about the fees charged to cash a check as well as required documentation – typically, you will be required to submit one or two forms of identification such as a drivers license, passport, workID badge, and perhaps a credit card with your picture on it.

All check cashing businesses charge a small fee, so doing a small research on those locally available may allow you find the one with the most favorable rates.

Subsequent to verification of your identification and the check’s validity, most local check cashing businesses will have you receiving your money in a matter of minutes as opposed to the three to five days with some banking institutions.

-

Nationwide Chain Stores

These stores provide check cashing services with requirements that are quite similar to local check cashing businesses – however, because of the risk of personal checks bouncing, there are limits to the amount of funds that can be made available by them, they include –

- Kmart

Kmart cashes personal checks for up to $500, and their fees are only $1, with exceptions under a few varying conditions. Kmart stores are available nationwide.

- Giant-Eagle

Giant-Eagle cashes personal checks, but with the condition that you must either apply for or have a Giant-Eagle Advantage Card to be able to cash checks.

- Publix

To cash a check at Publix you must provide a drivers license, state-issued photo identification, or military identification.

- Ralphs

Check cashing fees at Ralphs range from $3-$5.

A number of others also exist including; Costco, Copps, Bj’s Wholesale club, Albersons etc. each with specific requirements that ensure security of both parties.

Cashing personal checks doesn’t have to make daily life a challenge. You will find that using our guide the process will be hassle free and seamless.